Bodily Injury and Property Damage Liability

Bodily Injury coverage pays, up to the policy limits, your legal liability for injury to or death of others caused by a covered accident.

Property Damage coverage pays, up to the policy limits, your legal liability for damage to other’s property caused by a covered accident.

Accidental Death

Accidental Death benefit provides a payment to your estate in the event that you or your spouse dies as a result of a car accident or being struck by a car. Coverage can be extended to other drivers or family members for an additional premium.

Uninsured & Underinsured Motorist

Uninsured and Underinsured Motorist coverages pay, up to the policy limits, for covered accidental bodily injury caused by other drivers who have no insurance or not enough insurance to cover your losses.

Medical Payments

Medical Payments coverage pays, up to the policy limits, the reasonable medical expenses arising from a covered auto accident. This coverage applies under various circumstances to you, relatives living in your house, and other persons in your car.

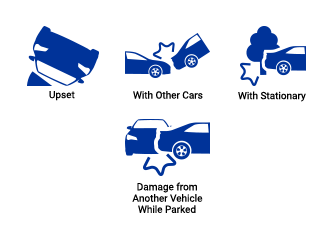

Collision

Collision coverage helps pay, up to the policy limits, for accidental damage to your vehicle caused by a physical collision or overturn.

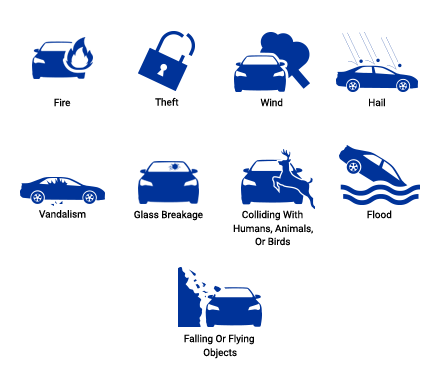

Comprehensive (other than collision)

Comprehensive coverage helps pay for accidental damage to your vehicle caused by circumstances other than collision.

New Vehicle Replacement

New Vehicle Replacement coverage will pay an additional amount (above the comparable value) to replace your damaged vehicle with a new auto of the same year, make and model, if:

- You are the original owner of the vehicle and have purchased collision or comprehensive coverage.

- You purchased the vehicle within 12 months before the accident date.

- Vehicle has been driven less than 15,000 miles.

- Only applies if Shelter determines car is a total loss.

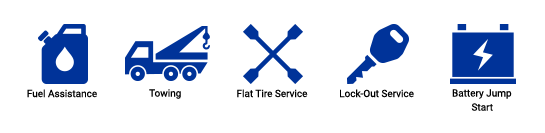

Road Assist

Road Assist* coverage provides the following for non‑accident situations:

If your vehicle is towed, coverage includes a Lyft ride voucher to help you get back on your way. Subject to availability. Terms and conditions apply.

Two levels of coverage options available. Restrictions and coverage limits apply. See your agent for details.

*Road Assist provided by Agero®.

ADDITIONAL COVERAGES YOU MAY ADD TO YOUR AUTO POLICY

Disability Income

If you are disabled and unable to work as the result of a covered auto accident, Disability Income coverage will provide you with a weekly payment for up to one year. Coverage is not dependent on whether you were the driver or passenger, or even a pedestrian.

Disability Income coverage may not be available in some states, but ask your agent about similar No-Fault coverage.

Uninsured Motorist Property Damage

Uninsured Motorist Property Damage is a coverage that applies to your vehicle if another driver was at fault in an auto accident and didn’t have current insurance. It will help pay to repair or replace your car.

Temporary Transportation

Temporary Transportation coverage helps you pay for reliable transportation while your car is out of commission after a covered loss. The amount of coverage you purchase represents the maximum amount we will pay for each day you use the rented vehicle.

Auto Loan/Lease (GAP) Insurance

The minute you drive it off the sales lot, your new vehicle begins to depreciate. If you’re involved in an accident during the first few years and your car is totaled, your Collision coverage will help pay you the comparable value of your vehicle. This may not be enough to cover the loan you took out to purchase the car. GAP Insurance pays, up to the policy limits, the difference between the comparable value of your vehicle and the amount you still owe on your loan for this vehicle.

Auto Loss of Use

Auto Loss of Use coverage will provide you with a single payment when your car is in the shop following a covered loss. Shelter offers coverage in many different amounts.

SWITCH AND SAVE DISCOUNTS

Our Switch and Save discounts are designed for new customers who transfer their car insurance to Shelter from another insurance provider. They include the following:

Prior Carrier Tenure Discount

Available to select vehicles based on the length of time your prior auto insurance policy was in force.

Prior Coverage Selection Discount

Available to select vehicles based on the selected limit of liability coverage on your prior auto insurance policy.

Evidence of Continuous Insurance Discount

Available to select vehicles with active prior coverage.

Other Discounts

Loyalty Discount

A discount available to renewing policies for select vehicles based on the number of years the policy has been in force.

Pay In Full Discount

Available to drivers who pay their premiums in full every six months or annually instead of monthly.

Length of Ownership Discount

Available to select vehicles based on the number of years you have owned the vehicle.

Companion Other Vehicles Discount

Available to select vehicles if you have other qualifying Shelter non-private passenger vehicle policies.

Companion Life Policy Discount

May apply to all Private Passenger vehicles if the named insured on the automobile policy is the owner or named insured on a qualifying individual life insurance policy. This discount will only be available for policies qualifying for the Companion Property Policy Discount.

Companion Property Policy Discount

Available to select vehicles if you have a Shelter Homeowners, Farmowners, Mobile Homeowners, Owner-Occupied Dwelling Fire or Farm Fire Policy.

Safe Driver Discount

Available to customers who have been accident and violation-free for the past three years. It may even be

increased if you are accident and violation-free after six years of maintaining this safe driver status.

Good Student Discount

Primary drivers who qualify as good students (based on class rank, grade average or academic honors) may qualify

for a discount on their overall premiums. The student must have an active license and provide proof of qualification

before age 19. A good student discount can be renewed as long as the driver remains an unmarried full-time student

under age 25.

Pay-in-Full Discount

Available to drivers who pay their premiums in full every six months or annually instead of monthly.

Passive Restraint Discount

Available for cars that have factory-installed airbags.

Accident Prevention Course Discount

Premiums may be reduced if you are the primary driver of a vehicle on your policy and you complete an accident

prevention course.

Driver Training Course Discount

Premiums may be reduced in some states if every driver in the household under age 21 has completed an approved

driver’s education course.

The discounts listed above may not be offered in all states, or may be offered under different terms. All coverage is subject to exclusions. Some types of property are not covered at all, and some types of losses are not covered. The policy purchased and the facts of each situation will control coverage in the event of a loss.

Visit our Auto Insurance page to learn more about our auto coverage options and discounts.

The product information contained on this website is informational only and not a statement of contract. All coverage options are subject to the provisions of the policy purchased and details of the policyholder's situation.